Guest Post:

By:

M. S. Sriganesh

Head Sourcing

Galaxy Surfactants Limited

With sagging crude market, OPEC (Organisation of Petroleum Exporting Countries) has restarted the talk of coordinating with other producers to balance market and support prices. Though in the past quotas have worked well, this time we believe will not work. Why?

Why OPEC thinks its strategy will work:

With crude correcting more than 50% to the current levels in the proximity of $50/bbl, returns of the producers have been severely impacted. The following 5 critical data points validate the approach of OPEC to keep producing and hold market share while waiting for less efficient producers to exit:

1. Crude prices in the proximity of $ 50/bbl, most producers are margin positive except for producers in US, Brazil, Russia and Canada which are the new competition. Hence at current levels for OPEC it is loss of profit rather than absolute loss while for its competitors it is an absolute loss:

2. However, over the last decade supported by high prices, producer countries have built up expenditure commitments for which a higher $/bbl price is required. Since most producers are producing at near peak capacity, increasing production to compensate is not an available option:

3. Commodity businesses are cyclical in which strong producers use up-cycles to build reserves which are used in lean periods, which is visible in this industry. Since OPEC is about National Oil Companies (NOC), Country reserves are a good measure. If the prices remain at $50/bbl levels, then except for Venezuela, Nigeria & Ecuador, most producers have a cushion to support. If the low prices continue to remain low, then the impact will spread and magnify:

4. Most producers have a high dependence on the ONG (Oil & Gas) industry with more than 30% share of the GDP:

5. Additionally, exports of these countries have a much higher skew in favor of ONG based products:

Consequentially OPEC has no option but to continue to produce to full capacity and let price fall making its more expensive competitors to exit. Quotas can be used to further reduce fragmentation in the market like in the past and get price support.

We see the above analysis optically correct while fundamentals show a different story. Here's the other picture.

5 reasons why quotas will not work:

The reason why we see this time as different is for the reasons below:

1. Changed strength of OPEC:

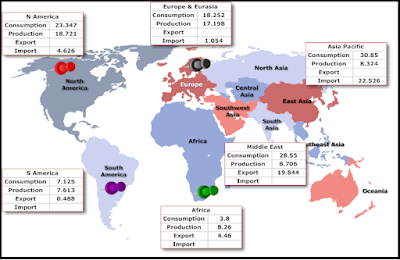

In the 1970's OPEC has controlling more than 50% of the global production which currently has fallen to near 40%. The global consumption growth over the decades has been largely absorbed by non-OPEC production. As a result, the strength of OPEC no longer remains similar to the past with higher number of players and more fragmentation.

2. Changing Customer profile:

In the 1970's, the largest consumer USA's imports were 88% from OPEC which currently is 15% (2.9 MBPD out of total consumption of 19.035 MBPD). Even today USA remains the largest consumer with largely regional production (N America) catering to its demand. If we see regional demand-supply mapping, the Americas are nearly balanced leaving the rest of the world to consume OPEC production. This leads to 5-6 countries (China, Japan, India, S Korea & Singapore) requirement balancing with OPEC surplus. The Americas is creating a regional Moat and forcing OPEC to focus on Asian consumption which is altering the bargaining power of the buyers. This is evident from the statement of the Indian Petroleum Minister that "oil producers should stop charging premium from its Asian buyers and offer better trade terms like selling oil without payment guarantee and on extended credit period":

3. Changing feed stock preference:

Natural gas has grown to become an alternative for transportation, power generation and industrial applications displacing crude demand. This has resulted in doubling of global natural gas demand from 1980 to 2010. From an environmental point of view, natural gas is a cleaner fuel than coal & crude adding traction to its demand. Lastly, natural gas is a regional play as there is limited role played by inter-continental movements. In short the markets have changed.

4. Power of the alternative:

US shale is considered the main competitor to OPEC. Shale industry is a private initiative unlike OPEC which is NOC. Private initiative coupled with innovation has brought about this revolution that even at $ 45/bbl (WTI) production is not falling of the cliff indicating a powerful signal to unravel. Producers are trimming cost & changing the drilling patterns to ensure that even at these low prices production continues. Efforts are underway to propagate the shale technologies regionally to countries like Mexico. In order to balance the grade requirements, swaps are being planned which will further reduce dependence. Also, globally for energy security considerations, propagation of this technology is underway. China, OPEC's largest consumer and also one of the largest technical proven reserve holder of shale, is working to exploit its reserves.There is a Chinese Government grant to encourage shale production. Europe which has been dependent on Russia for its gas and had had supply disruption issues, is already prospecting for shale in the UK, Poland, Germany, Romania, Denmark and Hungary and commercial drilling is expected to commence this year. Countries like Britain are changing rules to fast track this progress. As a pattern, decoupling from the Middle East & localizing is visible:

5. The SWITCH:

The shift of the swing producer status from Saudi Arabia to US creates a switch mechanism on supplies as a result of which a ceiling on crude prices has emerged. Every time the prices fall below the marginal cost of production, supplies get switched off and once the prices move above supplies get switched on. This is facilitated by shale, Tar sands, etc being onshore business which can support this mechanics. As a result, quotas can only move the needle from the margin negative to marginal cost of shale.

In summary:

Post the oil shock, surges in oil prices have been favorable to OPEC populations at the expense of the billions of consumers across the globe. Additionally, the middle east with a history of local issues, has always been perceived as an unstable source and engaged with due to lack of options. While coordinated action like quotas tends to work on short to medium terms to distort markets, in the long term competition happens at the level of competencies.

Two quotes from Saudi Sheik Ahmed Zaki Yamani who was also a minister in OPEC for 25 years reflect the current developments very aptly:

"The stone age didn't end for lack of stones, and the oil world will end long before the end of oil".

"Technology is the real enemy".

This shift in the industry dynamics makes is very interesting for top Asian buyers like China, Japan, India, Korea and Singapore to coordinate and unify the petroleum policies of its Countries and ensure the stabilization of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers free of distortion.

About M. S. Sriganesh:

Sriganesh tracks and analyzes markets from the perspective of its structure, competitiveness and evolution mainly using proprietary models derived from value chain analysis. These markets models used are capable of interpreting market dynamics for strategy formulation as well as price forecasting. Though these models are fungible across any market, specific use has been done in interested markets of crude, palm oil and metals.

He can be reached through his

Linkedin Page or Via email at mssganesh@gmail.com .

Source: Linkedin Article