Upcoming stock market panic to push gold to new highs? Here is an interesting view from our partners at the The WallStreet Window:

Stock Market Meltdown Likely to Drive Gold Towards $1,500 - Mike Swanson

I'm sure you are well aware of the big stock market drop that hit the US stock market on Friday as the DOW fell over 600 points following the UK BREXIT vote. Almost every sector of the stock market fell except for gold and Treasury bonds.I believe that what we saw on Friday was the simple start of a big drop that is going to turn into a total stock market meltdown in the coming weeks. In fact the whole drop may not end for a few months.

I know that might be hard to believe or accept, because very few people are saying that people should sell or be worried. A big problem in the stock market world is that when you tell people to sell many simply get angry at you. No one wants to be told to sell. Few people will listen and if you tell people to sell and things go up they will crucify you.This puts investment advisors and stock brokers in a bad spot.

If they encourage their clients to sell and the stock market goes up they are likely to see their clients go elsewhere. If things fall all of the other brokers and advisors are keeping their clients in so they can just say oh well or come up with reasons to hold and hope.So no one has anything to gain by getting people out of the stock market and everything to lose by doing so.

People have been sold a dream by the financial media and investment industry that all they have to do is put money into the stock market and do no thinking and no work and get rich one day.

But that is not how the real world works.

Unless someone wins the lottery by being lucky to own a stock that goes up for decades on end like buying Apple at $1.00 they are not going to get rich by doing no work in the stock market. You have to think and make changes from time to time in the investment game and most people just don't want to do that.

Stock market drops happen. You saw one in 2008 and in 2000 and this drop will eliminate the margin player and lazy bubble bull when it is done.And here is a secret. The world bankers and elites that rule the global financial system are not in charge of some control conspiracy causing crashes. Instead they are totally nihilistic and create situations that lead to disaster.

All they have done is kept things afloat since 2008 while their friends could make money in more stock market games and bank loans. So there is no real recovery just another rip-off.

Oh I'm sure they hoped their policies would eventually lead to economic growth and a good world for everyone, but that didn't happen. They got lots of people to believe them who wanted the markets to go up forever again so they could sit there watching TV do nothing and get rich and Clinton is in their pocket.

Gold is acting as a safe haven as money is coming out of world currencies and stock markets across the globe into "safety trades" and some of that money is flowing into gold, silver, and mining stocks.

I know there is a stock market gap up this morning, but at the rate gold went up on Friday and Monday and that the US stock market is falling I believe that gold will approach $1,500 an ounce before this stock market drop ends.

On Friday on CNBC I heard several people say that they were looking for the market to have a bad day Monday and that they might then buy on Tuesday. Everyone was looking for the UK to vote to stay in the Euro too! But the scenario many were talking about over the weekend was for a bad Monday that would lead to a big gap down Tuesday that would be the bottom.

So they were looking to buy a gap down today, but instead the market is gapping up.

I have no doubt there will be people thinking that this MUST go up now and will try to chase the gap up when in my view they should be selling! No one is really worried about the markets and I think most people have no clue how serious things are.

If you would look through all of the S&P 500 stocks and just ask yourself how many of them are in a position to make a new high and rally beyond it you would see how messed up the stock market is.

Incredibly I still have yet to receive ONE SINGLE email from ONE SINGLE person thinking about selling or expressing any worries at all since the Thursday vote.It's amazing.

I think today with so much ETF trading that so many people only watch ETF's and do not know what is happening to the stocks that make them up so they are unable to grasp what is happening.

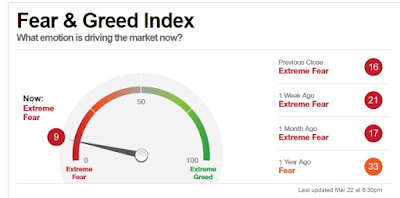

Stock market bottoms and even the end of corrections tend to come when there is panic in the markets and people sell-out on a bottom or buy so many puts to hedge their positions that the volatility premiums on the puts explode.

I have no idea if the market will go up all day on Tuesday or not and do not really care.

Most gap downs get sold, but I cannot predict what the market will do hour by hour or how it might end up on Tuesday's close, but I can tell you that there is no way in the world I believe we are near a bottom no matter what the stock market does today.Let me give you two of the simple reasons why.

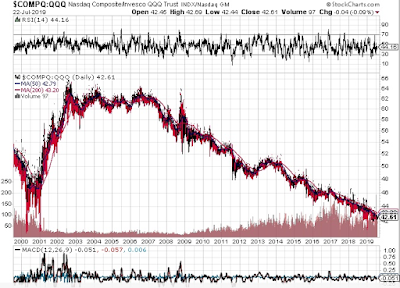

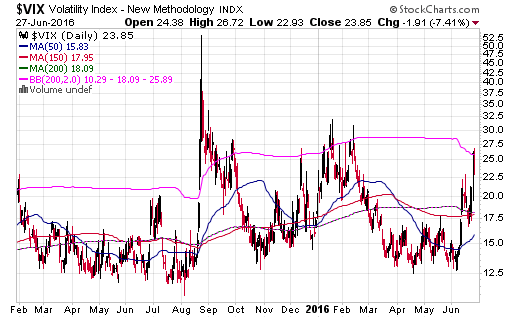

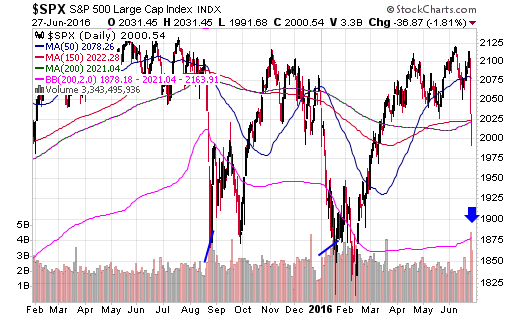

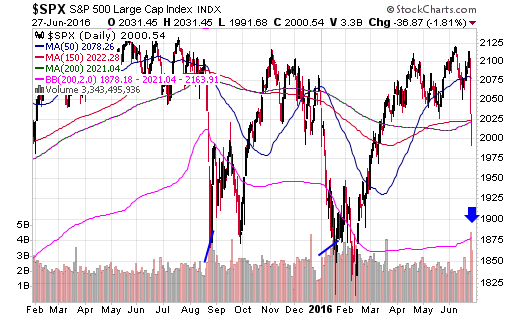

First of all look at this chart:

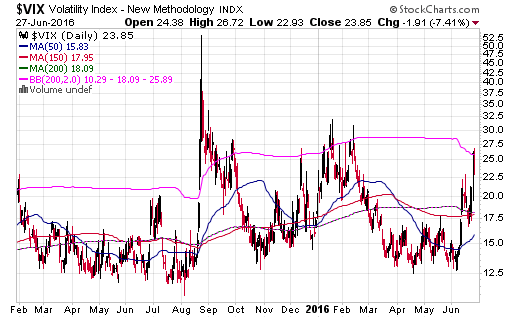

The VIX measures the premium options players are paying for volatility and goes up when they get scared. In August the VIX went over 40 and in January it went above 30. Moves to 30 often mark the end of stock market declines.

Incredibly on Monday the S&P 500 fell 36 points to close on 2000 way below its 200-day moving average and the VIX fell too! That meant that people were not scared at all as the market fell on Monday. If they were scared the VIX would have gone up instead of down! In fact many people were trying to buy the bottom or looking for signs of one.

I do not think this drop will end until the VIX goes over 30 and it probably will not end until it goes over 40! And maybe even 50!Why? Friday's action is a big clue to what is coming:

I want you to notice how huge the volume was on Friday. When you get a correction typically the volume expands once you get to the end of it as people go into pure panic selling mode.

In fact usually the biggest volume day during a decline is the day of the end of it. So on Friday we had massive volume at the start of the market drop and a big 600 point plus down day in the DOW.

That makes me conclude that when the market does finally put in a bottom that the volume will be even greater than it was on Friday and that the DOW will be down over 600 points during the day when it comes.And that means we are heading for a nightmare meltdown.

So when you think of where things are going and see how gold is acting as a safe haven it is not hard to project gold going to $1,500 during this stock market decline. Really gold started a new bull market this year and will go up much higher than that in the years to come, but a move to $1,500 seems doable now this summer.

We will get pauses on the way down for the US stock market such as today and it may take the market weeks or even a few months to finally bottom. Many people are fully invested in the stock market or on margin even. I fear that they are going to end up wiping themselves out on this decline.

Such people should reduce their risks and do some selling now instead of being forced to later.

The big stock market gap downs we saw in the past two trading sessions has trapped people in the market. What happens on a sudden big gap down to people that are invested in a market is that they do not want to sell on a big down opening so they hold and hope for a bounce. If the market just goes up a little off of the opening and then back down on the close they get screwed, but go into denial and hope a bounce will come tomorrow.

They look for support at hope levels.With the S&P 500, DOW, and Nasdaq all below their 200-day moving averages support levels are really imaginary and can only provide pause periods. The real bottom now will come in panic selling, not with some magic support robot buy. And it's lining up to be a massive and frightening day of panic when it comes. I know it's hard to think that way when the market is gapping up in the morning.

I have told friends of mine to step out of the way of the train and do not try to be a hero here.

And I have been telling them to buy gold and silver, but most American investors are starting to get hurt because all they own are US stock funds and I do not want them to get killed. They must step aside. They must save themselves! They need to have money in gold!

This is phase one of what I think is going to be a two phase cycle that will last for three to five years.

The first phase is a fast and furious stock market meltdown for a few months. BREXIT is not the cause of it, but it was the trigger. All BREXIT did was make an unstable situation in the financial market break like making cracks form in a dam.

The water is starting to leak out now.The second phase will mean totally skyrocketing gold prices.

Keep your crash helmet on! Do not take it off and if you do not have one make one for yourself!

I want you to survive this stock market drop. There is big money to be made in the coming years, but you must survive this current stock market meltdown to take advantage of it!

Ok you may not believe me and you may simply not want to believe me. Then here is what you need to watch for. If the market is fine like they say then it will go up! If it is not fine then it will end up going back down. It's as simple as that. So if you are afraid of taking advantage of a gap up to do some selling then you can wait to see if the market goes through Monday's low in the coming days.

If the bulls are right then the S&P 500 won't do that.

If it does that then you know bigger selling is coming and can get out. I cannot give you individual advice and you should talk to your investment advisor, but if it was me and I was fully invested in the US stock market and not diversified properly (junk bonds are no help here!) then I would either sell on the gap up or just sell when the S&P 500 goes through 1990 or opens below it. I would also own gold as I do own gold among other things!

For more on this visit our partner Michael Swanson on his website www.wallstreetwindow.com.